2022 tax refund calculator canada

Add lines 244 to 256. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

It is intended only as a general guide and is neither a definitive analysis of the law nor a substitute for professional advice.

. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. And is based on the tax brackets of 2021 and 2022.

Annual Tax Calculator 2022. 2021 Personal tax calculator EY Canada 2021 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. The best free online tax calculator for Canada.

2022 Tax Return And Refund Estimator. Since April 30 2022 falls on a Saturday your return will be considered filed on time in either of the following situations. Ad Earn Your Maximum Refund When You File Your Returns With TurboTax.

This calculator is intended to be used for planning purposes. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. Calculations are based on rates known as of March 29 2022 and includes changes from the New Brunswick 2022 budget.

The calculator includes most deductions and tax credits and can assist with your income tax planning. The calculator reflects known rates as of January 15 2022. This estimator may be utilized by virtually all taxpayers.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022. This marginal tax rate means that your immediate additional income will be taxed at this rate.

You simply put in your details get. Use the Canada Tax Calculator by entering your salary or select advanced to produce a more detailed salary calculation. We strive for accuracy but cannot guarantee it.

The 2022 tax calculator uses the 2022 federal tax tables and 2022 federal tax tables you can view the latest tax tables and historical tax tables used in our tax and salary. 2022 RRSP savings calculator. Start with a free eFile account and file federal and state taxes online by April 18 2022.

The Canada Tax Calculator provides State and Province Tax Return Calculations based on the 20222023 federal and state Tax Tables. Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax. This tax calculator aids you establish just how much withholding allowance or added withholding must be reported with your W4 Form.

It is not your tax refund. Province Select Province Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward. This is an optional tax refund-related loan from MetaBank NA.

The tax-filing deadline for most individuals is April 30 2022. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. This calculator is for 2022 Tax Returns due in 2023.

This handy tool allows you to instantly find out how much Canadian tax back you are owed. 2022 Personal tax calculator. Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2022.

Ad Plan Ahead For This Years Tax Return. Your average tax rate is 220 and your marginal tax rate is 353. The Canada Annual Tax Calculator is updated for the 202223 tax year.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. TurboTax Free customers are entitled to a payment of 999. It does not include every available tax credit.

ICalculator aims to make calculating your Federal and State taxes and Medicare as. Most people want to find out if its worth applying for a tax refund before they proceed. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables.

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. The Canada Tax Calculator by iCalculator is designed to allow detailed salary and income tax calculations for each province in Canada. Tax Advice Expert Review and TurboTax Live.

Calculate the tax savings your RRSP contribution generates in each province and territory. Use Smartassets Tax Return Calculator To See How Your Income Withholdings Deductions And Credits Impact Your Tax Refund Or Balance Due Amount. That means that your net pay will be 40568 per year or 3381 per month.

File Your Tax Returns With Confidence And Get Your Taxes Done Right With TurboTax. Shows combined federal and provincial or territorial income tax and rates current to. Tax Refund Calculator 2022 Canada.

This personal tax calculator does not constitute legal accounting or other professional advice. Reflects known rates as of January 15 2022. You have until June 15 2022 to file your return if you or.

The best starting point is to use the Canadian tax refund calculator below. It is mainly intended for residents of the US. How does the tax return estimator work.

Assumes RRSP contribution amount is fully deductible. 2 Turbotax Tax Refund Calculator1040 Tax Estimation Calculator For 2021 TaxesThis Tax Return And Refund Estimator Provides You With Detailed Tax Results During 2022Will The 2022 Tax Filing Season Be Normal39000 Plus 37C For Each 1 Over 120000. Intuit will assign you a tax expert based on availability.

That Means That Your Net Pay Will Be 40568 Per Year Or 3381 Per Month. Tax Refund 2022 Calculator. Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

Tax Refund Calculator The tax withholding estimator 2021 permits you to definitely calculate the federal income tax withholding. Loans are offered in amounts of 250 500 750 1250 or 3500. Calculate your combined federal and provincial tax bill in each province and territory.

If you are looking to compare salaries in different provinces or for different salary. Tax Refund Calculator 2022 Canada. 8 rows If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software.

Canada Tax Calculator 202223. The Canadian tax calculator is free to use and there is absolutely no obligation. Terms and conditions may vary and are subject to change without notice.

Youll get a rough estimate of how much youll get back or what youll owe. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison.

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

Loan Flat Icons Set In 2022 Flat Icons Set Flat Icon Icon Set

Income Tax Calculator Calculatorscanada Ca

Reasons For Outsourcing Payroll In Singapore In 2022 Payroll Outsourcing Staff Management

2021 2022 Income Tax Calculator Canada Wowa Ca

Taxes And Fees Paying Financial Charge Obligatory Payment Calculating Personal Income Tax Doing Your Taxes Tax Credit Meta Filing Taxes Income Tax Income

Simple Tax Calculator For 2021 Cloudtax

Ca Income Tax Calculator April 2022 Incomeaftertax Com

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Quicken R1 Deluxe 2017 App Bureco Money Management Personal Finance Infographic Finance Infographic

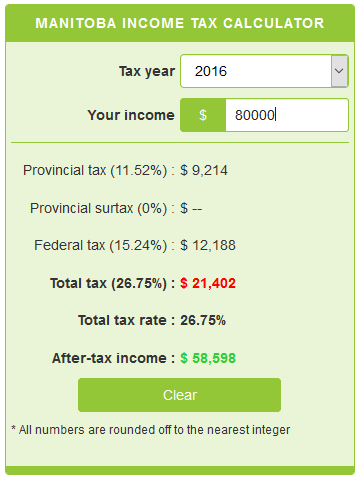

Manitoba Income Tax Calculator Calculatorscanada Ca

Ontario Income Tax Calculator Calculatorscanada Ca

Your 2022 Tax Fact Sheet And Calendar Morningstar

Pin On Awesome Blogs To Follow

Bc Income Tax Calculator Wowa Ca

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube